In the United States, people pay $1,502 annually for their car insurance. The rates vary from one person to the other. Also, the average price depends on multiple factors, such as the coverage type you choose, the territorial area as well as the driving history. Car insurance is usually costly. However, when you shop around, you might come across several discounts that can help you save more.

The apt coverage for you

Are you planning to select the best coverage in 2024? If yes, you can choose a liability coverage option that caters to the basic state standards. Alternatively, you can also opt-in for comprehensive coverage. Let’s have a look at each coverage:

- Liability coverage – It pays for every damage. However, it doesn’t cover when others cause damage to your car. It is ideal for old cars which don’t have increased value.

- Comprehensive coverage –It covers the damage that others face because of your faux pas. It also covers your car damages. If you want maximum security, this is the best option.

The basic requirements vary extensively based on the state. The three factors that determine the minimum liability include bodily injury in an accident, bodily injury for a person, and property damage due to the accident. Car insurance coverage requirements differ from state to state. In Arizona, for instance, the insured car drivers need to have personal insurance coverage. On the other hand, Connecticut needs both uninsured and underinsured motorist coverage. It helps to pay for the event in which a person accountable for a car accident can’t pay due to a lack of proper coverage. Interestingly, when it comes to New Hampshire, drivers are responsible for undertaking all financial accountability.

Other essential factors that determine car insurance rate in 2024

According to cheapautoinsurance.net, when you decide the coverage numbers for your car policy, you need to also look at other factors that can impact the annual premium cost. The auto insurance carriers take into consideration multiple factors that help to determine the individual car coverage and its yearly rate. The essential elements are:

1.The territorial location

Your home location or residing country/state has a vital role in deciding the car insurance coverage cost. It’s a fact that the state averages don’t vary extensively. But still, when you reside in specific neighborhoods, it can influence coverage costs significantly. For instance, in New York, the Brooklyn residents have to pay high average premiums owing to the increased population. Other factors include more commuters and increased car theft and break-in incidents. On the other hand, the Manhattan drivers have to pay less as the place is less prone to public transportation on an average day.

2.The car type

The car you drive has an impact on the car policy. It’s because the rate gets based on the car value. Do you use a brand new, costly sports car? If yes, chances are people have to pay more to repair or replace it. Hence, the premium will cost you more. However, when you use an old car, the coverage costs might reduce. The bonus gets decided based on your old car’s theft rating and safety rating.

3. Credit score

According to the latest statistics, the car drivers who have adverse credit claims, have to pay a high coverage premium, as compared to the drivers who have a good credit history. It is essential to know that a car driver who has a poor credit history can witness an extra $100 or more monthly to clear their car policy premiums.

4. The driving history

Car drivers need to take accountability for their driving history! The moment you encounter more accidents and get an increased amount of traffic tickets, you will find your car coverage premium increase exponentially. More accidents and inattentive driving prove you to be a high-risk driver, and the service providers, levy an increased car insurance rate on you.

5. Gender

This factor applies to drivers who are under 25 years. Today, gender plays a crucial role in the way people pay for their auto policy plans. For instance, the male drivers who are 24 years or younger than that pay $10 less annually for the car policy rates as compared to the female drivers of the same age bracket.

6. Age

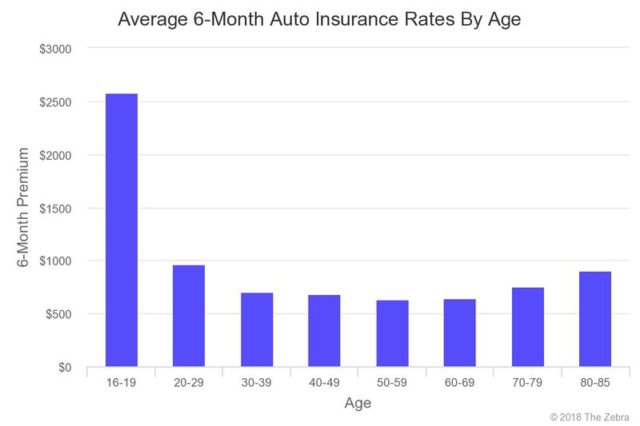

One of the crucial factors that impact car policy rates is age! If you are a young driver, the generation will have a specific role to play. According to the latest data and research results, teens are more into a rash and reckless driving. They are prone to more accidents and tend to disobey traffic rules. The old age bracket usually follows traffic rules and have fewer chances of getting into an accident. Hence, young, teenage drivers witness increased premiums when compared to elderly drivers.

These are some of the essential factors that you need to consider in 2024, to get your car insurance rate correct. You need to join hands with an expert auto insurance provider to get the best deal.