We have so many decisions to make every day, and it often feels like there’s no right or wrong choice. The range of choices can be overwhelming sometimes.

While the following points won’t answer the question for you, we hope that they’ll help you consider your options if you’re thinking about Medicare, and you can find even more info here.

In case you’re single, married, young, having a child, or old, you need some degree of medical coverage to secure yourself against monetary calamity in case of a genuine ailment or mishap. Regardless of whether you pick an individual plan or a group plan, there are significant decisions to be made that will influence not just the nature of your clinical consideration inclusion yet, in addition, your wallet. Surveying a portion of these decisions can help you settle on an educated choice that fits both your particular requirements and your spending plan.

Time of Life

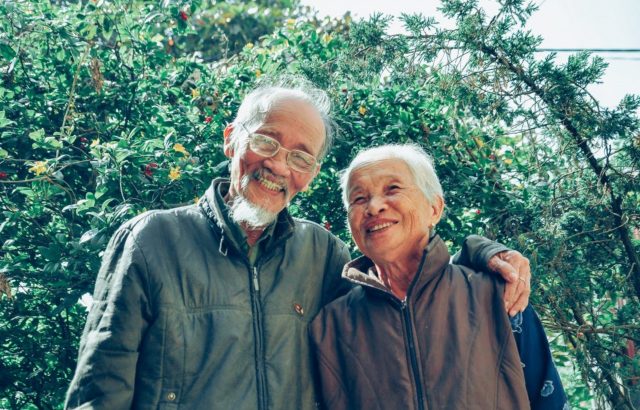

Perhaps the single most pertinent factor with regards to health and wellbeing is an individual’s time of life. Seniors are far more likely to require medical treatment than younger folks, so assessing your needs in terms of your age is a crucial requirement.

It could even be the case that you’re looking after older family members, so this would figure quite highly in your thoughts about what kind of coverage your senior family members need. Also, take into consideration that each individual differs as they age. Some will need more coverage than others.

Income and Employment

Getting the coverage that is right for your wallet is important. It makes no sense to have the most extensive insurance available without being able to comfortably afford the costs.

It also makes a difference if your employer is contributing to the costs, although obviously, this isn’t the case for everyone.

Pick your wellbeing plan commercial center

A lot many people with health care coverage get it through a business employer. In case you’re one of those individuals, you will not have to utilize the public authority protection trades or commercial centers. Basically, your organization is your commercial center.

On the off chance that your boss offers medical coverage and you wish to look for an elective arrangement in the trades, you can. However, plans in the commercial center are probably going to cost significantly more.

You can likewise buy health care coverage through a private trade or straightforwardly from a backup plan. In the event that you pick these alternatives, you will not be qualified for premium tax reductions, which are pay put together limits with respect to your month-to-month expenses.

Look at kinds of medical coverage plans

You’ll experience some letter set soup while shopping; the most well-known kinds of health care coverage approaches are PPOs, HMOs, EPOs, or POS plans. The benevolent you pick will help decide your cash-based expenses and which specialists you can see.

While contrasting plans, search for a synopsis of advantages. Online commercial centers generally give a connection to the outline and show the expense close to the arrangement’s title. A supplier catalog, which records the specialists and centers that take an interest in the arrangement’s organization, ought to likewise be accessible. In case you’re going through a business, ask your working environment benefits for the synopsis of advantages.

Basic or Extensive Cover

As with most modern choices, when you research health insurance policies, there will be a number of options with regard to the level of coverage you need. Whichever provider you go for, be sure to thoroughly check all the available products to ensure you have the right fit for you.

Spending tons of money to cover everything is not an option for most people, so we have to make as informed and educated a choice as is possible. This may mean taking a lower coverage amount, or it may mean a little more.

Analyze Private Insurance Plan Organizations

Depending on the place you live, you will have many options for private insurance. Expenses are lower when you go to an in-network specialist since insurance organizations contract lower rates with in-network suppliers. At the point when you leave the organization, those specialists don’t have settled upon rates, and you’re regularly on the snare for a higher bit of the expense.

In the event that you have favored specialists and need to continue to see them, ensure they’re in the supplier catalogs for the arrangement you’re thinking about. You can likewise straightforwardly inquire as to whether they take a specific wellbeing plan.

On the off chance that you don’t have a favored specialist, search for an arrangement with a huge organization, so you have more options. A bigger organization is particularly significant in the event that you live in a provincial, local area since you’ll be bound to track down a nearby specialist who takes your arrangement.

Take out any plans that don’t have neighborhood in-network specialists, if conceivable, and those with not many supplier alternatives contrasted and different plans.

Final Thoughts

It isn’t easy choosing insurance for your family. However, when you break it down, you find that there are a few stand-out considerations that might sway your choice. Caring for elderly or chronically unwell family members is one of these circumstances.

Medical insurance isn’t cheap either, given that the technologies involved are on the cutting-edge of science.

It’s still possible to find decent insurance if you assess your needs and do your research. Ultimately, it’s all about looking after the most important people in your world.