Having the right tools makes tracking business expenses much less painful. These resources will aid in establishing everyday business cost monitoring habits.

This will enable you to watch your small company expenses closely. And improving your spending management will boost your profitability.

Keeping track of your company spending also makes tax time much more accessible as many costs may be written off.

Regular spending tracking increases the likelihood that you will notice possible tax deductions. As a result, you’ll have to pay fewer taxes (or get more back).

Is It Necessary to Track Expenses?

According to the U.S. Small Business Administration (SBA), financial management includes accounting, forecasts, financial statements, and funding.

Budgeting, locating credit sources (and always having some credit available), and maintaining a separate bank account for employee payments are all fundamental financial management techniques.

Only some understand that financial management is a critical stage in a small business. It is better to keep financial records in order not to think about quick loans, such as a 100 dollar or 300-dollar loan direct lender for employee salaries. In this case, you will always know all the expenses and income.

The financial health of small firms and prudent financial management were determined to be directly correlated by the Federal Reserve Banks of Chicago and San Francisco.

Companies shared four factors in above-average or exceptional financial health: knowledge and expertise with credit products, a greater level of unused credit balances, frequent budget reviews, and cash put aside for payroll.

How to Track Expenses in a Small Business

We’ve compiled a few methods to help you manage your costs automatically so you can stop doing the time-consuming, manual work:

You Should First Decide Between Cash And Accrual Accounting

To pick a set of guidelines for when to disclose income and costs, each small firm must. Consistency in recordkeeping for tax reasons is ensured by doing this.

Generally, small enterprises with three prior tax years’ combined annual gross revenues of $25 million or less are permitted to account on either the accrual method or the cash basis (the previous threshold was $5 million).

Having outsourced accounting services in your business allows you to access a team of skilled professionals who are dedicated to handling financial tasks efficiently and accurately. This frees up your time and resources, enabling you to focus on core business activities and make informed decisions based on accurate financial information.

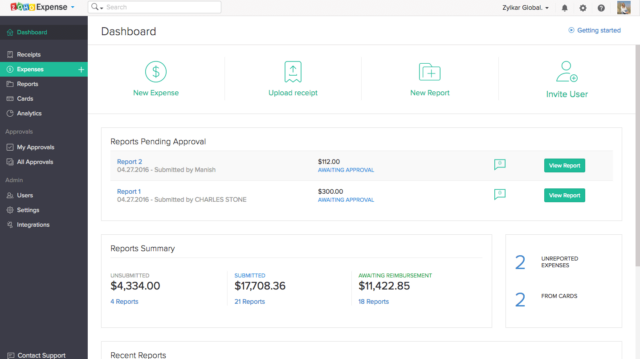

Pick Software To Automatically Record Spending In A Single Location

A study of Americans found that 58% indicated that their companies currently utilize some or just cloud-based solutions for accounting and finance tasks.

Whether it’s paying rent, making payroll, or managing vendor bills, tools like Coupa’s platform make managing, organizing, and paying costs simple. Each element of the price is essential. Especially wages, because these are daily and hourly waste.

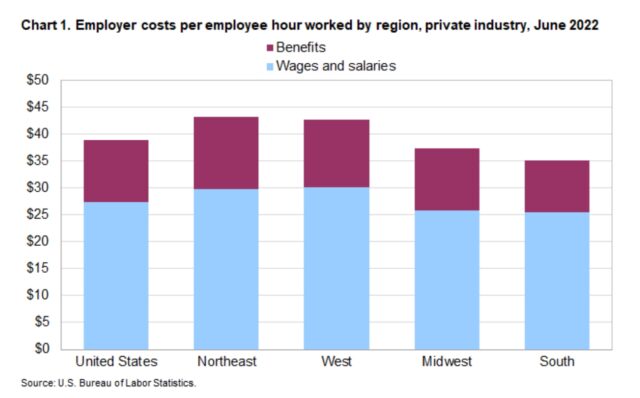

In June of 2024, the hourly compensation costs for private sector employees ranged from $35 in the South to $43 in the Northeast. In the end, much money is obtained, so it is better to write everything down at once.

You may streamline the process of keeping track of spending while improving the accuracy of the data.

The accounting software also provides reporting options that give details about costs for each category or let you assess them against the prior year. For businesses seeking to free up more time and resources to focus on core activities, considering outsourced accounting services can provide expert financial management without the need to maintain an in-house accounting team.

Utilize Ocr To Digitize Receipts

Some cost management software includes or supports mobile applications that let staff members or company owners use their smartphones’ cameras to scan receipts.

Each employs OCR technology, which turns text into code that computers can read.

Nevertheless, investing in a separate receipt scanner enables businesses to scan the item, study it, and sort it – either by automatically matching the information to specific areas in the accounting software or by enabling human sorting.

Review And Classify Costs Regularly

A small firm is more likely to survive and expand the more often it checks its financial information and comprehends it better.

Business executives must understand the organization’s present and short-term financial health, and a critical component of that is to review spending and associated measures regularly.

The odds are against small enterprises. Only around half of the small company enterprises persisted for five years or more, and only about a third lasted for ten years, even before the epidemic.

However, they play a vast and crucial role in the health of the national economy. Nearly half of the private sector workforce works for companies with less than 500 people, and the SBA’s Office of Advocacy attributes them to 44% of all economic activity in the country.

Benefits of effective cost tracking

Effective cost tracking offers several key benefits for small businesses. Firstly, it enables businesses to gain a clear understanding of their financial health by providing accurate and up-to-date information on expenses, including payroll programs.

This comprehensive view helps in making informed decisions regarding budgeting, pricing, and resource allocation, ensuring optimal financial management. Secondly, cost tracking helps identify areas of potential cost savings and efficiency improvements, leading to enhanced profitability.

By closely monitoring expenses, including payroll, businesses can detect unnecessary expenditures and take corrective actions, boosting their bottom line. Additionally, cost tracking provides valuable insights for tax reporting and compliance purposes, ensuring businesses remain compliant with payroll regulations.

Overall, effective cost tracking, including payroll programs, empowers small businesses to make strategic and informed financial decisions, leading to improved financial performance and long-term success.

Best Tools For Small Companies To Monitor Expenses

You may save time and money and improve staff productivity by using software to monitor your spending.

Additionally, it offers insight into your company’s spending patterns, making your life (and that of your accountant) much simpler around tax season.

Mint

Mint, a popular personal cost tracker, is also an easy-to-use tool for freelancers and smaller companies to keep track of their spending.

You may monitor your credit score and set goals and budgets inside the app. All this information is accessible via a simple-to-read dashboard, allowing you always to be aware of your position.

QuickBooks

One of the most well-liked payroll management software is QuickBooks, which is also helpful for tracking expenditures.

You may monitor, organize, and manage company spending with this practice software. Additionally, it may assist in generating invoices, keeping track of kilometers traveled, tracking deductions, and much more.

Circula

You can manage employee spending and company perks with Circula, a sophisticated employee finance platform.

This program is intended to provide a simple user interface, reduce process costs, and keep your small company compliant.

The AI solutions offered by Circula are beneficial for automating policies and managing expenses. Additionally, you may link with HR and payroll programs, vacation booking websites like TravelPerk, and ERP programs.

Zoho Expense

In its free plan, Zoho Expense provides a good selection of functionality, such as mileage monitoring, connections to personal cards, customer and project tracking, and accounting connectors.

The Standard plan supports unlimited users, whereas this plan supports up to three.

Unlimited receipt auto scans travel and purchase requests, per diem rates, comprehensive customization, and more are included in higher-tier Premium and Enterprise programs.

Additionally, users may organize schedules and add tags, locations, and cost centers to charges.

Conclusion

You should have all you need to start monitoring spending now that you know the fundamentals. These simple steps will put you on the road to better-organized company finances.

Try to keep track of your small business’s costs as soon as you can. When a recent transaction occurs, recalling the amount you spent is much simpler.